NSN 2815-00-856-0322 48447226, 00-856-0322, 008560322

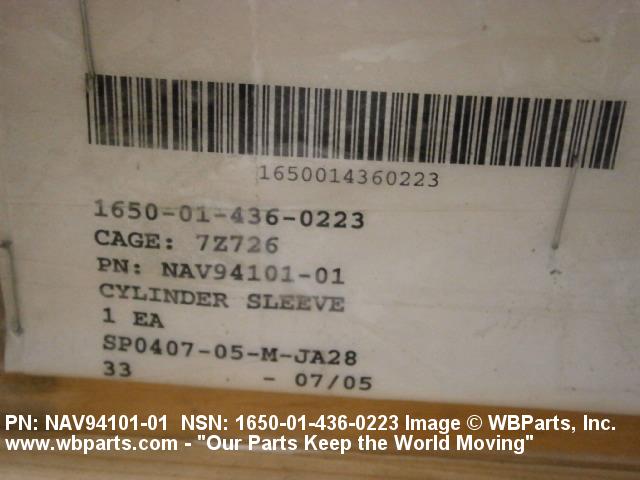

Product Details | CYLINDER SLEEVE

2815-00-856-0322 A tubular metal item designed primarily as a replaceable wear surface within the cylinder bore of a piston type internal combustion engine, compressor, or reciprocating pump.20716500058Aircraft Hydraulic, Vacuum, and De-icing System Components28050063Gasoline Reciprocating Engines, Except Aircraft; and Components28100068Gasoline Reciprocating Engines, Aircraft Prime Mover; and Components28150029Diesel Engines and Components41300045Refrigeration and Air Conditioning Components43100028Compressors and Vacuum Pumps43200020Power and Hand Pumps

Part Alternates: 48447226, 2815-00-856-0322, 00-856-0322, 2815008560322, 008560322

Engines, Turbines, and Components | Diesel Engines and Components

| Supply Group (FSG) | NSN Assign. | NIIN | Item Name Code (INC) |

|---|---|---|---|

| 28 | 01 JAN 1960 | 00-856-0322 | 16756 ( CYLINDER SLEEVE ) |

Cross Reference | NSN 2815-00-856-0322

| Part Number | Cage Code | Manufacturer |

|---|---|---|

| 48447226 | 55380 | HATCH & KIRK, INC. DIV HATCH & KIRK INC |

Request a Quote

What Our Customers Say

Compare

NSNs for Compare ( up to 4 ): Add 2815-00-856-0322

Related Products | NSN 2815-00-856-0322

Restrictions/Controls & Freight Information | NSN 2815-00-856-0322

| Category | Code | Description |

|---|---|---|

| Hazardous Material Indicator Code | N | There is no data in the HMIS and the NSN is in an FSC not generally suspected of containing hazardous materials |

| Demilitarization Code: | A | Non-Munitions List Item/ Non-Strategic List Item - Demilitarization not required. |

| Precious Metals Indicator Code: | U | Precious metal type is unknown |

| Category | Code | Description |

|---|---|---|

| NMF Description | 182600 | TILE/MOLDING COMPOSITION |

| Less than car load rating | ||

| Less than truck load rating | W | Rating Variable |

| Water commodity Code | 581 | unknown |

| Originating Activity Code | XX | |

| Air Dimension Code | A | Shipment is not a consolidation and does not exceed 72 inches in any dimension. |

| Air Commodity | V | Vehicles, machinery, shop and warehouse equipment and supplies, including special tools and equipment, ground servicing and special purpose vehicles, marine equipment and supplies, repair and maintenance parts for the above. |

| Air Special Handling | Z | No special handling required. |

| Special Handling Code | 9 | unknonwn |

| HAZMAT | ||

| Type of Cargo | Z | No special type of cargo code applicable |