NSN 2540-01-645-8880 1000006336, 100-00063-36 , 7408097084

Product Details | 1000006336, 100-00063-36 , 7408097084

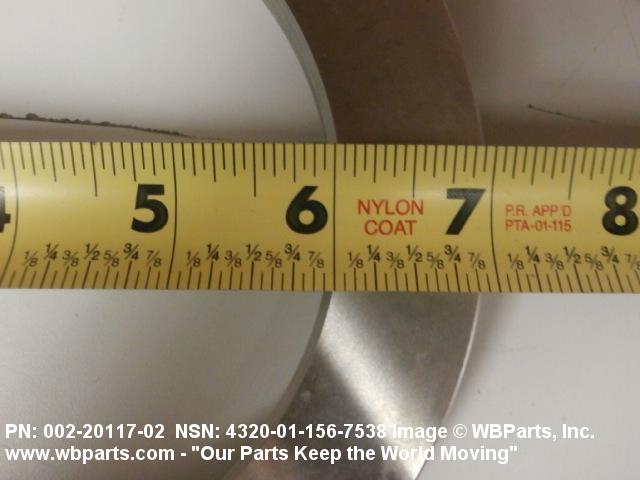

2540-01-645-8880 An item so shaped as to deflect one or more of the following: dust, dirt, grease, oil, or liquid into a desired direction or away from a particular area. Can be attached to a stationary or with a revolving part. May or may not be a mechanical device.21516150056Helicopter Rotor Blades, Drive Mechanisms and Components16600062Aircraft Air Conditioning, Heating, and Pressurizing Equipment16800049Miscellaneous Aircraft Accessories and Components25200039Vehicular Power Transmission Components25300060Vehicular Brake, Steering, Axle, Wheel, and Track Components25400035Vehicular Furniture and Accessories28050063Gasoline Reciprocating Engines, Except Aircraft; and Components28150029Diesel Engines and Components28250029Steam Turbines and Components28350096Gas Turbines and Jet Engines; Non-Aircraft Prime Mover, Aircraft Non-Prime Mover, and Components29950042Miscellaneous Engine Accessories, Aircraft43100028Compressors and Vacuum Pumps43200020Power and Hand Pumps49300041Lubrication and Fuel Dispensing Equipment53400020Hardware, Commercial

Part Alternates: 1000006336, 100-00063-36 , 7408097084, 8097084 , 2540-01-645-8880, 01-645-8880, 2540016458880, 016458880

Vehicular Equipment Components | Vehicular Furniture and Accessories

| Supply Group (FSG) | NSN Assign. | NIIN | Item Name Code (INC) |

|---|---|---|---|

| 25 | 2015183 | 01-645-8880 | 10255 ( DEFLECTOR, DIRT AND LIQUID ) |

Request a Quote

What Our Customers Say

Compare

Related Products | NSN 2540-01-645-8880

Restrictions/Controls & Freight Information | NSN 2540-01-645-8880

| Category | Code | Description |

|---|---|---|

| Hazardous Material Indicator Code | P | There is no information in the HMIS; however, the NSN is in an FSC in Table II of Federal Standard 313 and an MSDS may be required by the user. The requirement for an MSDS is dependent on a hazard determination of the supplier or the intended end use of the product |

| Demilitarization Code: | A | Non-Munitions List Item/ Non-Strategic List Item - Demilitarization not required. |

| Precious Metals Indicator Code: | A | Item does not contain precious metal |

| Automatic Data Processing Equipment: | 0 | Represents items with no ADP components. NOTE: Codes 1 through 6 are only to be used when the item is Automatic Data Processing Equipment (ADPE) in its entirety and is limited to the type meeting only one of the definitions for codes 1 through 6. (See code 9) |

| Category | Code | Description |

|---|---|---|

| No Freight Information | ||